Forward-thinking insights focused on a more sustainable tomorrow.

E-commerce Growth and the Industrial Real Estate Boom: Investments in New Facilities Are Critical To Meeting Market Demand

The need for high-quality industrial real estate across the U.S. is a direct response to the accelerated growth in e-commerce. The COVID-19 pandemic, coupled with shelter-in-place policies, sped up adoption of e-commerce by consumers, fueling demand for industrial space from retailers who are experiencing exponential growth in online sales. To meet consumer demand, retailers quickly pivoted, and business-to-business transactions have been replaced by business-to-consumer purchases. As a result, investments in warehouse, distribution, fulfillment, sortation, and delivery facilities are on the rise.

Investments in new facilities are critical to meeting market demand generated by companies engaged in e-commerce, third-party logistics, packaging supply, and the food industry. Historically, the manufacturing and retail sectors have driven demand for industrial real estate, but e-commerce companies are driving growth in logistics infrastructure. According to Brick Meets Click, from March 2020 to February 2021, U.S. online grocery sales skyrocketed from $6.5 billion to $8 billion. The uptick has led major grocers to invest in cold-storage facilities, micro-fulfillment centers and warerooms to expedite deliveries. Reverse logistics is also driving up demand as consumers are three times more likely to return products they bought online.

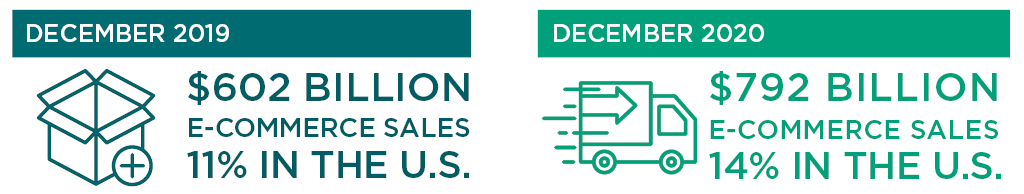

According to the U.S. Census Bureau of the Department of Commerce, e-commerce sales are on the rise.

For the past five years, industrial vacancy rates have been at historic lows across the U.S. Low vacancy rates, coupled with positive rent growth, has translated into stable returns for investors. As a result, capital is readily available, and developers are increasing investments in industrial assets, including speculative space to meet future demand. CBRE Research found that $1 billion in incremental e-commerce sales generates demand for 1.25 million square feet of warehouse space. Key to keeping investments on track is site selection, site development, and strategic partnerships.

Site Selection & Location Strategies

Site selection strategies are critical to a company’s vision and growth plans. Developers are working with corporate end users or tenants to understand their business objectives, and with design teams to deliver new facilities in core markets. A careful analysis of the market and sites available for development will result in the optimal site location to support operations. Geographical Information Systems (GIS) are frequently used to make smarter location decisions. The technology is used to cast a wide net on sites available for development and then the sites can be refined to meet end user criteria. Key factors that influence site location decisions include:

Large customer population—End users are investing in growth markets where their customers are based. Right now, land is scarce in high population centers, but there are opportunities to redevelop existing buildings into single or multi-tenant industrial facilities.

Urban infill—In many communities, urban infill sites, vacant retail centers, or big boxes, are being redeveloped for last mile facilities. Having logistics space closer to customers can play a key role in reducing transportation costs and the time it takes to deliver goods, which is vital in the highly competitive e-commerce industry.

Shovel ready sites—Developers are focused on speed to market and shovel ready sites that have zoning, environmental approvals, and the transportation and utility infrastructure in place to handle the development program. Many developers are evaluating distressed assets, which already have the infrastructure in place.

Transportation networks—End users need access to highways, railways, and ports to deliver goods to businesses and consumers. Last mile facilities will benefit from sites with multiple points of access. Different ingress and egress options facilitate traffic coming into and going out from the site with the normal traffic patterns of the surrounding community.

Cost and availability of skilled labor—Distribution and fulfillment centers are becoming more automated with robotics, but they remain labor intensive. Partnerships with economic development agencies, community-based organizations, and colleges are increasingly more important to establish regional training programs to confirm that companies have a skilled and diverse workforce.

Sustainable, Resilient Site Development

Sustainable master plans offer a comprehensive roadmap for a company’s growth and a site’s development. An effective plan will guide decision-making and help companies reach their sustainability goals. The planning process informs the design of critical infrastructure to support the development program in a way that achieves operational efficiencies, while minimizing environmental impacts.

Developers and retailers, such as Prologis, Target, Walmart, and Amazon, have made commitments to achieving sustainability goals, reducing greenhouse gas, and accelerating the transition to net carbon zero across their companies by 2040. Sustainability goals can be met through careful site analysis and planning. Key considerations include:

Sustainable Buildings—Green buildings will increase employees’ wellbeing and productivity. Advancements in materials and technology can be seen in highly efficient energy windows and computerized management of building systems.

Stormwater management—Industrial facilities have large footprints, including buildings, parking, and loading areas and, as a result, many impervious surfaces. Through an understanding of soils and drainage issues, stormwater management systems and mitigation strategies, including rain gardens, constructed wetlands, and infiltration basins, can be designed to support the development program.

Water Efficiency—Water reuse and efficiency measures reduce water supply and disposal costs and decrease the energy needed to pump, heat, or chill water. For instance, non-potable water can be used for landscape irrigation, custodial purposes, and building systems.

Heat island effect—Paved surfaces absorb extra heat from the sun, creating hotter temperatures which stresses HVAC systems and drives up energy costs. White roofs, light-colored pavements, and landscaping are being used to reflect solar energy, cool down buildings, reduce the heat island effect, and save on energy demand.

Landscaping—Buffered landscape zones can reduce the intrusiveness of an industrial facility to a surrounding community. Native plantings around parking areas or green roofs can also aid in mitigating the heat island effect.

Resiliency—Developments near the coastline or flood plain are subject to coastal zone management guidelines which confirm that finished first floors, utility infrastructure, generators, and electrical infrastructure are elevated above the floodplain.

Renewable energy—Large single-story industrial buildings can easily accommodate rooftop solar panels, which may generate 50 to 80 percent of a single fulfillment facility’s annual energy needs. Watch this video to learn more about Renewable Revolution.

Electric Vehicle (EV) infrastructure and fleets—Retailers are increasing investments in EV technology for last mile deliveries to reduce greenhouse gas emissions and improve air quality. Electric vehicle charging infrastructure is often incorporated into industrial sites both for the delivery fleet and employees’ vehicles.

Transportation Demand Management (TDM)—TDM plans will support the end users’ operations by addressing mobility and maximizing employees’ access to transit, ridesharing, carsharing, and biking.

Fiscal & Economic Impacts & Partnerships

Economic development agencies (EDAs) play a critical role in attracting capital investments and spurring job creation within communities. They use Economic Development Incentive Programs (EDIPs) to add value and influence location decisions by improving the profitability of a business investing at a particular site. Tax Increment Financing (TIF) is often used to lower taxes and offset the cost of a site’s development in return for the benefits, jobs, and tax revenue that a business brings to a community. When the economic benefits are combined with fiscal impacts, communities will have a better understanding of whether or not the additional revenue generated by a business outweigh the cost of the services that the city will need to provide as a result of growth.

Grant programs are also used to offset investments in infrastructure, such as rail and transportation access. Many states administer infrastructure and economic development grants which help communities address gaps in local roadway infrastructure funding, while increasing the marketability of underutilized properties, quickly converting them into shovel-ready assets.

When EDAs work hand-in-hand with developers they can revitalize underperforming assets and spur economic growth. Recently, The Virginia Economic Development Partnership worked with the City of Portsmouth, the Hampton Roads Economic Development Alliance, and the Virginia Port Authority to secure a $60 million investment by Lineage Logistics in a new cold storage facility in Portsmouth, Virginia. Lineage qualified for state benefits from local programs, which helped to offset capital costs. The investment by Lineage in Hampton Roads led to the redevelopment of an underutilized waterfront site, created 60 new jobs, and helped strengthen the Port of Virginia’s supply chain and logistics infrastructure.

How VHB Can Help

VHB is working with economic development agencies, developers, brokers, State Departments of Transportation, and municipalities, to expedite the development of e-commerce facilities for end users. We are partnering with owners to find the optimal site location and using data driven analytics to help them make smarter location decisions. VHB is analyzing the capacity of sites and leading the due diligence, permitting, and site design necessary to deliver the critical infrastructure required to meet the needs of end users and opening day schedules. Our deep knowledge of markets and sites on the East Coast, coupled with our understanding of the development process, and strong relationships with regulatory and municipal agencies, enables us to keep our client’s investments on track. Are you faced with the challenge of delivering industrial space to meet the needs of your business or end users? Contact Brittany Gesner or Vinod Kalikiri today to start planning for tomorrow.